GeneOnline’s Pick: Top 10 Global Industry News Stories in 2023 (Part 1)

Looking back at 2023, although the threat of the global COVID-19 outbreak has gradually receded and the World Health Organization announced in May that COVID-19 is no longer a “Public Health Emergency of International Concern,” there were still many high-profile stories that shocked the biopharma market in the past year, including massive partnerships and M&A deals, legal battles, drug pricing controversies in the U.S. and several major business decisions. As 2024 unfolds, GeneOnline’s editorial team will recap the top global biotech industry events of 2023.

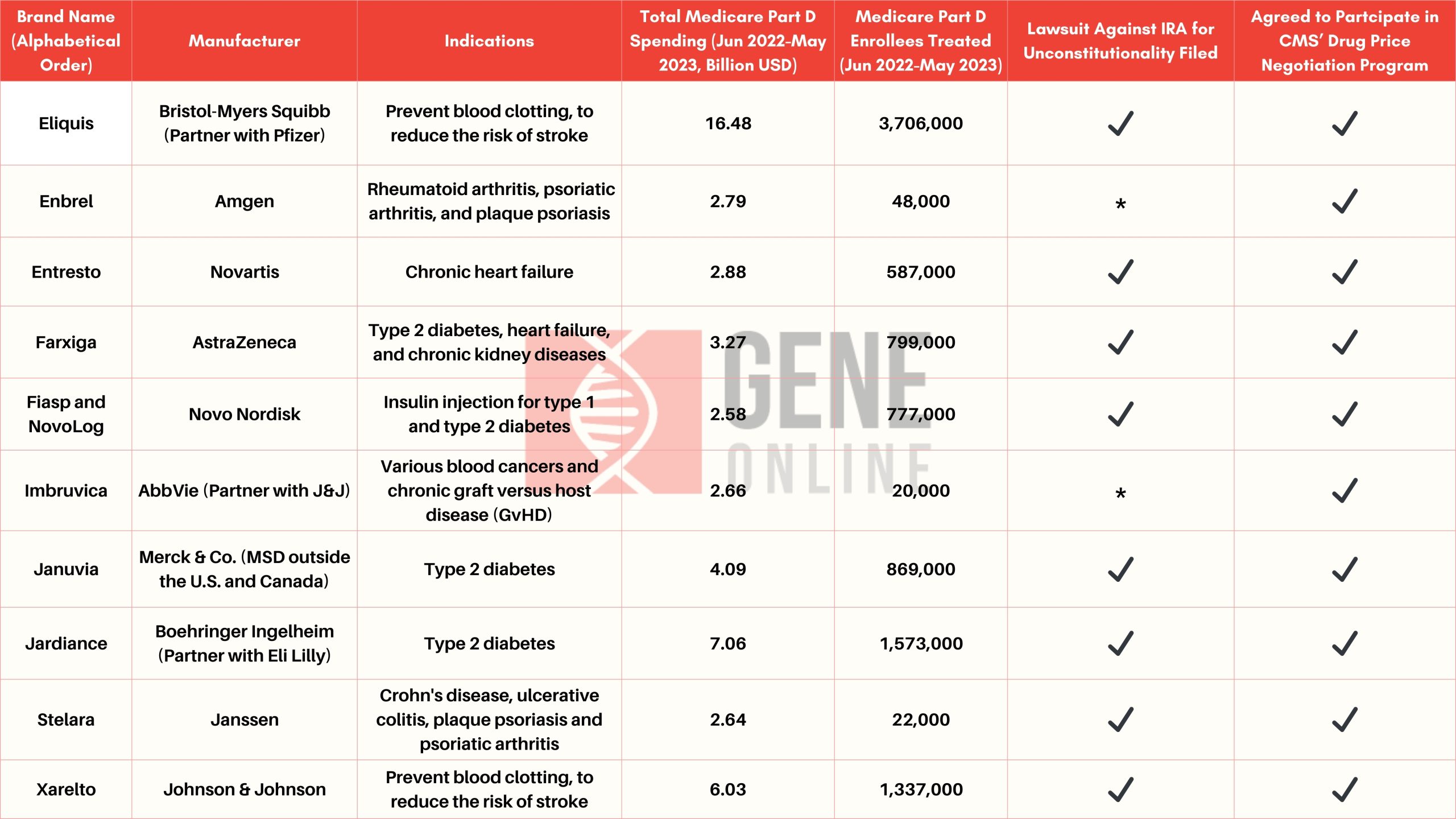

1. Drugmakers Sue the U.S. Government for Unconstitutionality as the Drug Price Controversy Persists

On August 29, the Biden administration exercised its mandate under the Inflation Reduction Act (IRA) to release a list of 10 prescription medicines that will be subject to the first-ever price negotiations by the U.S. Medicare health program that covers 66 million people. Pursuant to the IRA, the new prices, which are expected to take effect on January 1, 2026, must be at least 25% lower than the original prices (the longer the drugs have been on the market, the larger the price reduction required by the government). Pharma companies that refuse to participate in the negotiation or fail to sell their products at the new price in the future will face substantial fines.

According to some analysts, the U.S. government could save up to $98.5 billion over the next 10 years through drug price negotiations. However, many pharma companies involved have expressed strong opposition to the Biden administration’s efforts to force such negotiations, fearing a severe hit to their revenues and impediments to new drug development programs. While all the drugmakers included in the list have indicated their willingness to enter into discussions with the government, they all shared the view that they were forced to do so given that they had no choice but to comply with the dire consequences of refusing the negotiations. Besides, a number of affected companies are trying to halt the talks by legal means, and at least eight have already filed lawsuits against the Biden administration, alleging that the IRA is unconstitutional (as of early October).

Related article: HHS Issues Initial Guidance on Negotiation Program as Government’s Latest Move to Reduce Drug Prices

2. J&J’s Struggle with the Talcum Powder Lawsuit and Illumina’s Divestment of GRAIL

On January 30, a federal appellate court in Philadelphia dismissed the bankruptcy filed by the LTL Management, a Johnson & Johnson (J&J) subsidiary, in October 2021, ruling that the pharmaceutical giant cannot use a corporate bankruptcy to escape the liabilities stemming from lawsuits over its allegedly carcinogenic talc-based baby powder products. On April 4, J&J proposed another $8.9 billion settlement in bankruptcy court, but it still did not prevent LTL’s bankruptcy filing from being dismissed by the federal court again in late July.

Related article: Johnson & Johnson to Pay $8.9 Billion Over 25 Years to Settle Talcum Powder Lawsuits

In the second half of 2023, with the successive setbacks in LTL’s bankruptcy filings, the once-suspended cancer claims lawsuits have been revived, and more cancer lawsuits have been filed against J&J by patients who said they developed cancer related to asbestos in J&J’s talc-based baby powder, resulting in more than 6,000 new claims within this period. As of December, the total number of cases has exceeded 50,000. Although J&J has promised to remove the powder from shelves worldwide by the end of the year, and plans to pursue the LTL bankruptcy in federal court for the third time in a bid to reach a settlement, the legal battle is expected to continue well into 2024.

Another hotly anticipated case in 2023 is the antitrust dispute over Illumina’s $7.1 billion acquisition of GRAIL, a cancer blood screening company. The European Commission (EC) and the U.S. Federal Trade Commission (FTC) have launched investigations and lawsuits against the sequencing giant, citing the acquisition as a suspected monopoly of the market for early cancer screening products and an impediment to technological innovation. In July, the European Commission imposed a record-breaking fine of €432 million on Illumina, and ordered the company again in October to unwind the completed acquisition of GRAIL at a specified deadline. After Illumina received another unfavorable decision from the U.S. Court of Appeals for the Fifth Circuit in mid-December, the company finally dropped its appeal and announced that it would revert GRAIL back to an independent company in accordance with the EU’s official divestment order. Details regarding the divestment are scheduled to be announced in Q2 2024.

3. M&A Market Got Active in 2023 as Two Blockbuster Deals Finally Closed

According to a recent market analysis and forecast report by PricewaterhouseCoopers (PwC), 2023 was a reasonably strong year for the pharmaceutical and life sciences sector with both deal value and volume of M&A close to pre-pandemic levels, while total deal value increased by 37% compared to 2022. Throughout 2023, a number of billion-dollar M&A deals have been announced or finalized, and as of the end of December, there were at least four blockbuster transactions that exceeded $10 billion (compared to only two in 2022), highlighting the market’s enthusiasm (A separate article will be prepared by GeneOnline’s team to introduce the top 10 M&A deals in 2023).

Among many major deals, Pfizer’s $43 billion acquisition of Seagen, an American cancer drug company, announced in mid-March is not only the largest biopharma M&A deal in 2023, but also the first time since 2019 that the deal value exceeded $40 billion. Although the FTC once intervened in the transaction owing to antitrust concerns, the agency finally gave the green light after Pfizer agreed to donate the royalties from the U.S. sales of its cancer drug Bavencio (Avelumab, an immune checkpoint inhibitor) to the American Association for Cancer Research (AACR), culminating in the completion of the deal on December 14.

Related article: Pfizer Acquires Seagen for $43 Billion to Capture Leading Position in Oncology

Amgen’s $27.8 billion takeover of Horizon Therapeutics was the largest M&A bid in the biopharma industry in 2022, yet the deal was delayed by an antitrust controversy and the FTC filed an antitrust lawsuit against Amgen in mid-May in an attempt to halt Horizon’s acquisition. Following some twists and turns, the two companies reached a consent order agreement with the FTC on September 1, clearing the legal hurdles for closing the deal, which was ultimately completed on October 6.

Related article: GeneOnline’s Pick: Top 10 M&A Deals in 2022

4. First FDA-approved RSV Vaccine Marks a Breakthrough in Global Preventive Medicine

As the COVID-19 pandemic tapered off and the market demand for COVID vaccines declined, focus of the vaccine industry has recently shifted to the prevention of another common respiratory pathogen, the Respiratory Syncytial Virus (RSV), an RNA virus similar to SARS-CoV-2. Before 2023, no RSV vaccine on the market could overcome the regulatory barriers to obtain approval, leading several international pharmaceutical giants to invest in developing vaccines to protect against RSV in an attempt to compete in this multi-billion market.

In early May, GSK’s adult RSV vaccine, Arexvy, took the lead in obtaining FDA approval to protect individuals aged 60 or older, setting a global precedent. In early June, EU regulators also gave the green light for the vaccine to be used in the same adult population. Separately, Pfizer’s vaccine, Abrysvo, also received FDA approval at the end of May for use in adults aged 60 years or older.

Apart from older adults, newborns and infants are also vulnerable to RSV infection and in pressing need of vaccination. Studies have found that vaccinating pregnant women can reduce the risk of RSV infection in infants during their first six months of life. Pfizer is currently the only company to have filed regulatory applications for RSV vaccines for both pregnant women and adults 60 years of age or older. Following its success in entering the elderly RSV vaccine market, Abrysvo also won FDA approval on August 21 to be used for women between 32 and 36 weeks of pregnancy, making it the world’s first FDA-approved RSV vaccine for mothers and infants to protect newborns from the harmful effects of the virus.

Related article: Recent Highlights of the RSV Vaccine Battle, with More Regulatory Approvals in Sight

5. AI Leading Revolution in the Biotech Industry, and Drugmakers Making Big Moves One after Another

Applications of artificial intelligence (AI) in the biotech and healthcare sectors were one of the hottest topics in the industry in 2023, spanning drug discovery, process optimization, smart hospitals, telemedicine, medical image analysis, and beyond. Throughout this year, many renowned biopharma companies scrambled to enter the R&D of AI technology or enhance their influence in related markets through mergers and acquisitions, collaborations, and technology licensing. One of the most notable companies among them is Sanofi, which already invested over $8 billion in 2022 in signing cooperation or licensing agreements with four AI-related biotech companies. By June 2023, Sanofi has even announced its ambition to “go all-in” on AI and data science, aiming to become the first pharmaceutical company powered by AI across all its operations.

Related article: Sanofi Goes “All In” to Lead the AI Revolution in Pharmaceutical Industry

Sanofi entered the second half of the year with two new signings, the first of which was an agreement in early October with BioMap for a strategic partnership worth more than $1 billion. The French pharma giant will leverage BioMap’s advanced AI model to gain a better understanding of protein structure to advance the design and development of large-molecule drugs. In early December, Sanofi announced a $140 million partnership with Aqemia, another French pharmaceutical company, to combine generative AI with quantum physics algorithms to rapidly design innovative small-molecule drug candidates for serious diseases.

Aside from Sanofi, Merck KGaA is also very active in AI-powered drug development in 2023. In late September, the German life sciences company signed collaboration agreements with UK-based BenevolentAI and Exscientia, with a combined total of more than $1.3 billion in upfront payments and milestones for drugs in oncology, immunology, and neuroscience. Less than 10 days later, Merck announced an expanded collaboration with Quris-AI, an Israeli AI innovator in the pharmaceutical realm, to further utilize the latter’s AI platform to identify hepatotoxicity risks for drug candidates.

Related article: Merck KGaA Extends Collaboration with Quris-AI for Groundbreaking Advancements in Drug Safety

©www.geneonline.com All rights reserved. Collaborate with us: service@geneonlineasia.com