The World of ESG: Standards and their Organizations

More than just a means of making money, the markets demand a great contribution from the companies operating in them. Along with profit and loss, many investors see the value in quarterly reports regarding a firm’s pollution and office personnel statistics before purchasing shares. This environmental, social, and governance (ESG) investing strategy allows financial institutions to avoid damage to their reputations and wallets, as well as offer firms another feather to place in their proverbial caps. This increased positive regard comes with many incentives for industries to increase their standards.

Setting New Benchmarks

ESG policies and their financial interest incentivize companies to care more about the environment they operate in and the health and happiness of workers. As a result of the increased company PR and the financial opportunity it creates, many stakeholders in the company can benefit from its activities without necessarily being shareholders in the firm.

The Foundations of ESG Organizations

ESG standards vary based on certifying organization and what authority one finds credible and often depend on the region in which a business operates and the particular economic niche that the business occupies. These standards create an ecosystem of companies and governing bodies specialized in creating, espousing, reporting, and complying with ESG standards, resulting in a wealth of complex roles to play.

Significant ESG Organizations

The European Financial Reporting Advisory Group (EFRAG)

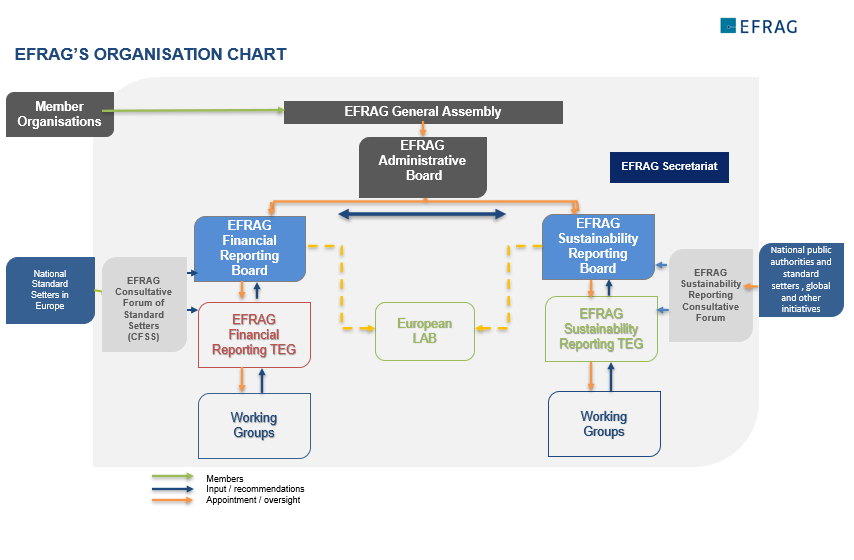

EFRAG is a private association established in 2001 with the encouragement of the European Commission to serve the public interest. The organization extended its mission in 2022 to provide technical advice to the European Commission in the form of a fully prepared draft outlining EU Sustainability Reporting Standards and draft amendments to these Standards. EFRAG organized these activities into two pillars:

A Financial Reporting Pillar: This pillar of the organization helps contribute to the construction of the ESG financial rules and ensures that it represents the views of the European Commission in the IASB´s (International Accounting Standards Board) standard-setting process.

Sustainability Reporting Pillar: This second pillar is responsible for drafting EU sustainability reporting standards and related amendments for the European commission.

The Global Reporting Initiative (GRI)

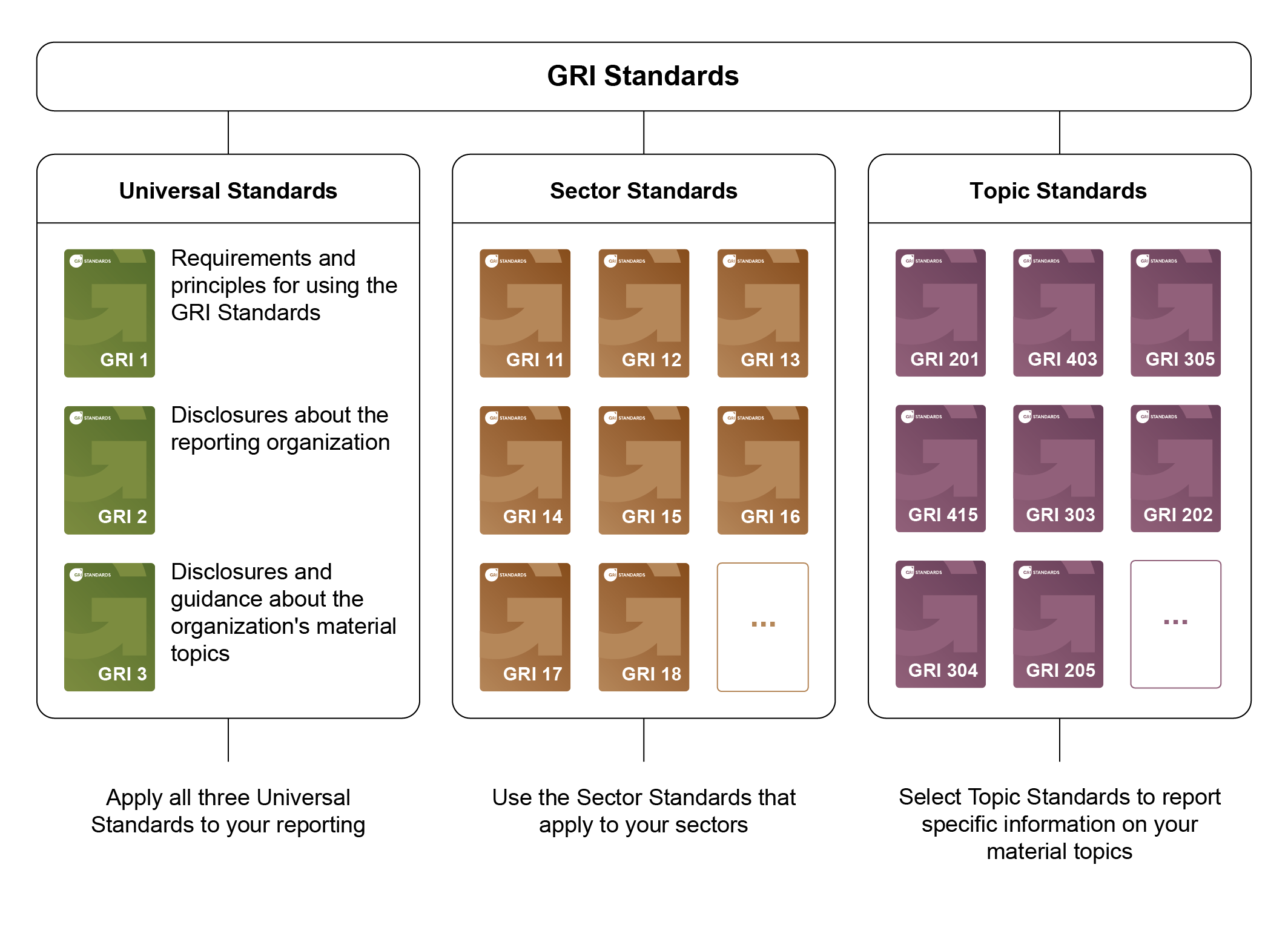

Founded in September 1997, this Amsterdam-based organization has a reporting presence in over 100 countries. The GRI has its own set of rules, the GRI Universal Standards, the GRI Sector Standards, and the GRI Topic Standards.

The GRI Topic Standards contain disclosures for information on waste, occupational health and safety, and tax. Each standard incorporates an overview of the topic, disclosures specific to it, and how an organization manages its associated impacts. The Global Sustainability Standards Board (GSSB) approves these standards created by the GRI.

The International Sustainability Standards Board (ISSB), created by the IFRS, also incorporates the Sustainability Accounting Standards Board (SASB) standards until their planned replacement by the IFRS sustainability disclosure standards. The IFRS Foundation Trustees created the International Sustainability Standards Board (ISSB) in 2021 to respond to companies’ urgent demand for transparent financial-related sustainability disclosures. The IFRS recently followed up by assuming responsibility for SASB Standards when it merged with the Value Reporting Foundation (VRF) this past August. The VRF is a global nonprofit that previously maintained these Standards. SASB Standards identify the subset of environmental, social, and governance issues most relevant to financial performance and enterprise value for 77 industries.

These various certifying organizations came to their position by being at the head of their respective industries or having the support of progressive governing bodies (or both). The world of ESG is wide and deep in the number of industries it touches and the levels of organizational infrastructure involved with rule-making, reporting, and compliance. Subsequent pieces will discuss issues of reporting agencies and their market consequences.

To read more GO GREEN articles, click here.

©www.geneonline.com All rights reserved. Collaborate with us: service@geneonlineasia.com