JPM 2024: More Noteworthy Industry Stories and Updates of Long-rumored Cytokinetics Acquisition

The 42nd JP Morgan Healthcare Conference (JPM 2024) has finally come to an end. The 4-day conference brought together thousands of the best minds in the biotech, pharmaceutical and medtech sectors from around the world to explore business opportunities, pursue partnerships and attract new investments. Some of the biggest names in the industry also shared updates on financial progress, operational changes and new products, among other things. Wrapping up the event, GeneOnline’s editorial team has compiled some of the notable stories that came out of this year’s edition of the JPM Conference.

Related article: JPM 2024: AZ, Ginkgo and Moderna Provides Business Updates, Illustrating Optimistic Prospects

Drug Price Controversy Continues, Posing Concerns for JPM 2024 Participants

Entering 2024, the drug price negotiations under the Inflation Reduction Act (IRA) between the Biden administration and major drugmakers will move into another phase, in which Centers for Medicare & Medicaid Services (CMS) will provide a maximum fair price and a justification to affected drug companies (these drugmakers will have 30 days to accept or counteroffer CMS’ initial offer). Then CMS will publish maximum fair prices agreed upon between the agency and participating drug companies in September, which will go into effect in January 2026.

The drug price controversy was also one of the many industry issues that attracted active attention and discussion among the pharma companies, investors, and consultants invited to JPM 2024. Some analysts suggest that the drugmakers on the negotiation list will not give in easily and are bound to make counter-offers. Besides, given that 2024 is a presidential election year, the Biden administration may make drastic cuts when setting new prices out of political pressure.

Under the IRA, after finalizing the new prices for the first 10 chosen drugs, CMS will select more drugs from Medicare Part B and Part D each year to be included in the subsequent rounds of pricing negotiations. Thus, participants’ concerns already extended beyond the ongoing talks to the future implementation of drug pricing reforms.

Related article: HHS Issues Initial Guidance on Negotiation Program as Government’s Latest Move to Reduce Drug Prices

One such concern stemmed from Biden’s December 2023 statement that the government may use the government’s “march-in rights” under the Bayh-Dole Act of 1980, suggesting on X (formerly Twitter) that his administration “is proposing that if a drug made using taxpayer funds is not reasonably available to Americans, the government reserves the right to march in and license that drug to another manufacturer who could sell it for less.” Some participants pointed out that if the Biden administration exercised such 43-year unused rights to take back drug patents from companies, it would establish a “dangerous and damaging precedent” that would severely undermine the incentives for drug manufacturers to collaborate with universities and research institutes to develop new drugs.

Another controversial issue is the differential treatment of small-molecule drugs and biologics under the IRA. The bill stipulates that biologics will not be subject to price negotiations for 13 years following the FDA approval, while small molecules only have a grace period of 9 years. Several participants expressed their confusion over this arrangement and criticized that the bill would deal a severe blow to the revenues of pharma companies from small-molecule drugs, thereby discouraging them from investing in small-molecule R&D projects (including radiopharmaceuticals) in the long run. Given that the majority of these drugs are designed for cancer treatment, cancer patients will be the first to bear the brunt and be “disproportionately affected”.

Amazon Rolls Out New Programs to Raise People’s Awareness to Their Digital Health Benefits

According to the U.S. Bureau of Labor Statistics, employees leave nearly 30% of their total compensation on the table through unused benefits, and nearly a quarter of U.S. adults report they are unaware of all the benefits available through their health plan. In a bid to address such lack of awareness and enrollment in digital health benefit programs, Amazon is rolling out new Health Condition Programs, facilitating easy discovery of health benefits to manage chronic conditions like prediabetes, diabetes, and high blood pressure.

The technology conglomerate will collaborate with digital health companies to simplify the process of checking coverage, applying for programs, and managing health conditions. If individuals are covered for specific Health Condition Programs through their health plan or employer, they may access connected devices, personal care teams, health coaching, and nutrition planning, often at no additional cost. The initiative is also integrated into the Amazon shopping experience, where additional health care benefits are surfaced to customers browsing health-related products.

Omada Health, a San Francisco-based digital care solution provider with over 20 million eligible members, joins Amazon’s Health Condition Programs as the first launch partner. Amazon’s platform allows users to check their eligibility for Omada’s programs and seamlessly enroll, aiming to reach those unaware of available programs and increase enrollment for Omada’s existing 1,900-plus employer and health plan customers.

Related article: Amazon Pharmacy Implements Automated Discount Coupons Which Improved Insulin Affordability

Novartis Reportedly Quits Cytokinetics Acquisition; Subsequent Details Remain Uncertain

At the beginning of JPM Week 2024, there were rumors that Novartis, which began the year strongly with a trio deals, was in advanced talks for the acquisition of Cytokinetics. At that time, certain sources indicated that the two companies were likely to announce the transaction during JPM 2024, and the total value of the deal could reach up to $10 billion.

However, the Swiss pharma giant seemed to change their mind over the week. In an interview with CNBC on January 9, Novartis CEO Vasant Narasimhan clarified that the company’s M&A strategy so far is centered around smaller deals involving sub-$5 billion assets, meaning that the San Francisco-based heart-drug developer, with an estimated market cap reaching nearly $10.6 billion prior to the opening of JPM 2024, would probably not be an acquisition target at this moment. Soon after, Reuters and the Wall Street Journal reported that Novartis had dropped its pursuit of Cytokinetics, meaning that the industry would still have to wait for the first $10 billion-plus biopharma acquisition in 2024 to come to fruition.

Currently, Johnson & Johnson and AstraZeneca are also among the pharma companies rumored to be interested in acquiring Cytokinetics, and it remains to be decided whether these two potential suitors will enter into acquisition talks after Novartis’ or whether a multi-billion deal will ultimately be reached.

Related article: JPM 2024: GSK Buys Aiolos Bio for $1.4 Billion, Cytokinetics Acquisition Sparks Three-way Contest

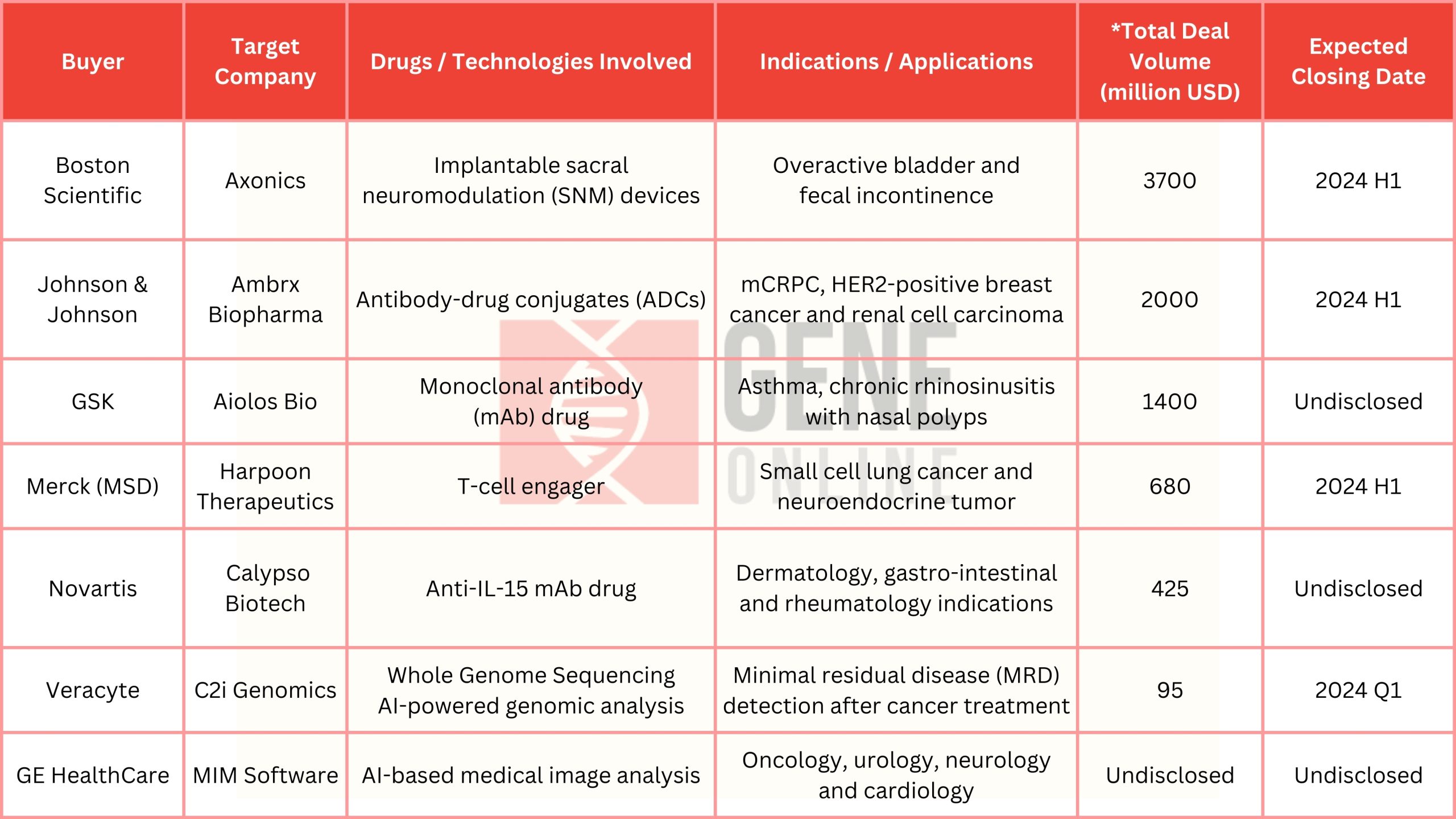

The following table, compiled by GeneOnline’s editorial team, shows the acquisitions made during the JPM Week 2024 (January 8-12).